In the previous posts, we covered the ‘4Ps framework of Embedding’ and how the businesses considering ‘embedding’ can think about ‘Product Market Fit in Embedded Finance’.

In this post, let’s take a step back. Let’s see how a platform can go about deciding whether ‘embedding’ is something they should even consider to begin with.

There was a reference to Alfred Lin (of Sequoia Capital) in the last post about how he shared a simple, well articulated framework that a marketplace / platform can use to gauge the need of embedded finance. It goes as following :

Do my supply or demand sides even need credit?

If Yes, what will be the uplift for them and consequently, my platform?

Who will take care of all the hassles such as regulatory compliance, building out the right product and ensuring flow of credit at competitive prices? (especially when I am a non-fintech marketplace that wants to focus on its core business)

A majority of the marketplaces reach step 2 and have some notion of how to gauge the uplift, but step 3 is the killer where they run into a wall.

Then there are a few who commit blunders at step 1, especially on the supply side.

There have been instances where poorly designed surveys have led to marketplaces being blind to the financing needs of their sellers. (survey questions that identify sellers having access to credit without digging deeper to understand whether it is personal credit, informal financing and what rates they get it at)

They then risk their sellers operating under financial stress or losing them to competition that identifies and caters to their financing needs.

If the marketplace believes that there is a credit need to be met, then the best way to enable it, is to embed it in their applications.

However, they need to assess how well poised they are to do so. They need to build a business case that begins with an assessment of where they stand today.

The following approach is one of the ways marketplaces / platforms can carry out this assessment :

Map the profile of the prospective borrower

Create detailed personas of multiple customers who can be prospective borrowers. For a home rentals marketplace as an example, it can be their hosts, the suppliers / service partners and the demand side customers.

What data points do they capture about the prospective borrower at the time of on-boarding? Can they assist in compliance, reducing information asymmetry with lenders and providing a seamless loan application process to the borrower (such as by pre-filling their loan applications)?

What are the types of cash flow and their frequency of flow?

Nail the credit problem to be solved

Paint a qualitative description of the problem

Paint a quantitative description of the problem

How acute is the problem for the prospective borrowers and what are the current alternatives?

How many prospective borrowers are there on your marketplace?

Carve out the credit product

Create the list of possible offerings (loan types : pre-shipment / post-shipment / term loan / credit line etc)

Construct the product :

Tenure type

Borrower constitution type

Interest related details

Is end use of loan open or closed (defined)

Additional information on product

Map their business activity data that can be relevant for credit underwriting.

What data can you really share with a third party or lenders to help your customer avail credit?

How easily accessible and shareable is that data?

What additional value can you add as an embedding marketplace?

Post loan disbursal, what data signals on borrower’s business activity can be a part of an early warning system for the lender?

If you are plugged in with borrower’s cash-flows and carrying out payouts, can you facilitate loan repayments for the lenders?

In all of this, as an embedding marketplace, the role it is playing is that of an agent of the borrower.

In doing so, its main aim has to be to improve the financial health of the borrower and not just provide credit for the sake of providing credit.

With that mindset, it truly needs to immerse itself to better understand and gauge the financial health of the prospective borrowers.

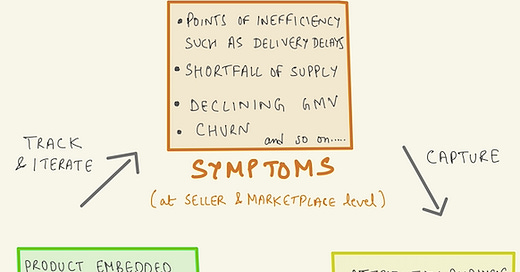

It needs to be on the lookout for symptoms at marketplace and customer level, that depict that there is an issue. Then, it should carry out a thorough diagnosis before attempting to solve the problem and build a solution.

A strong business case has to be substantiated with relevant, measurable data points and analytics used by marketplaces and platforms have improved at a great pace recently. Utilising the right tools and identifying the right attributes to track will determine the type of products marketplaces create and embed.

This is what will differentiate them when ‘every company is a fintech company’.