Emb.F[x] and what's coming next

The rise of 'Embedded'

Software ate the world. It permeates every walk of our life today. It is truly intertwined with everything we do and surfaces wherever we go. We must ask ourselves; has it grown to support us and improve quality of life as expected in every sense or has it grown unencumbered like a wild weed in some ways and is in need of pruning?

In 1960, Marketing Professor E. Jerome McCarthy popularized the ‘4Ps of marketing’, which are still taught in Marketing 101 in every business school. Product, Place, Price and Promotion have been the go-to framework for many Brand Managers for decades.

When it comes to software products, however, what frameworks do Product Managers (a role inspired by the Brand Manager role) refer to? This question is significant because many of the software products we use and a sizeable portion of those that drive some of the most critical aspects of our lives are subpar. Product types range from those that return search results in 0.9 seconds to others that have led to blunders worth USD 900 Million.

In 2005, Professor Clay Christensen introduced a framework called ‘Jobs to be done’ that has become popular amongst many Product Managers. It can be used to distil the essence of millions of lines of code in simple terms of what job the code does for a user.

A new approach to guide the software builders, especially in Fintech, that is starting to become popular is ‘Embedded Finance’. It might not sound so but it is essentially all about providing a product for a ‘Job to be Done’ precisely when and where it’s needed, in a product that consumer uses already.

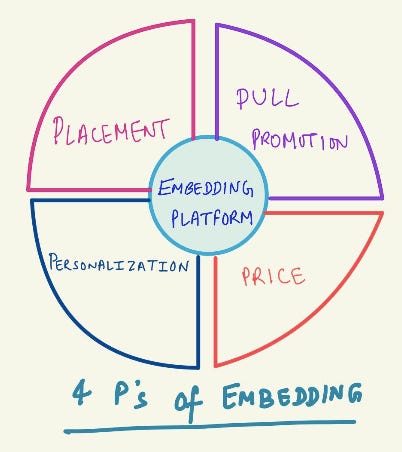

The 4 Ps for ‘Embedded Products’ can be:

Personalization - Is the embedded product personalized to cater to the user persona and their need?

Placement - Is the product embedded at the right place and in the right context?

Price - Is the product optimally priced for the user? (by means of reducing information asymmetry using user’s data with Embedder)

Pull Promotion (vs Push Promotion) - Is embedding of the product at the ‘Right Pull Point’ when it’s relevant for the user and the chances of conversion are high? (By contrast, a push based approach is a blanket promotion that leads to an underwhelming response)

What does this mean for the software products in the future and how will they be different from the ones we use today, or have used in the past?

The software product in the embedded paradigm will be formulated and assembled at the instance when you want to conjure it up. Users will bring all of their pre-defined preferences, which will be coupled with machine learned preferences, making every product experience different for each different user.

However, on Emb.F[x], Embedding in the context of Finance is going to be the core subject of learning and discussion. Finance is stressful for the majority of people, and, with the exception of a few products (such as Venmo), they don’t enjoy using financial products. It is the job of the financial software builders to understand and build the best product experiences for these users and ‘embedding’ is going to be one of the most important approaches to do so.

A preview of upcoming topics and posts :

"Embedded Product as a Service" (EmPaaS) and how it will change the way we design, develop and deploy products.

Two-way embedding in Finance

Embed or you are dead? The question for every company looking to embed.

Embedded vs Extended lending, what is true embedding?

Open Credit Enablement Network (OCEN), learnings from working on one of the most advanced embedded lending infrastructure in the world

Comparing the US vs India lending infrastructure

Embedded products, Babbage and Jacquard’s Loom

Embedded lending and what an Embedder wants

The emerging use cases for Embedded lending

Legal frameworks for Embedded lending

The rising need for Cash flow based lending in post Covid 19 world

The Cash flow based lending value chain

The analysis and shifting of power in Cash flow based lending value chain

Business models in Embedded finance

The Go to Market strategies in Embedded finance

The IKEA effect in Embedded lending

Measuring Embedded Lending uplift for a marketplace or a platform

The Product - Marketplace fit and not just Product - Market fit for embedded lending

The role of Technology vendors in Embedded Finance

The role of Derived data providers in Embedded Finance

The shapes and forms of Embedded Finance - the scope of product design innovation

The Principal - Agent Problem and Moral Hazard in Embedded Finance

The Embedded and the financial health of the customer

The role of data / information collateral instead of physical collateral for underwriting

The strategy and roles of ‘Derived Data Providers and Underwriting Modellers’ in Embedded Lending

The strategy and roles of Tech Vendors in Embedded Lending

The implications of Embedded Lending for online lending marketplaces

The difference in Embedding - Aggregator vs Platform

The evolving role of Credit Bureaus in Embedded Lending

The rise of long tail marketplaces in Embedded Lending

The objective is to learn, share and relearn through this medium about ‘Embedded Fintech’.

Looking at "embedded products" after reading your article is making a lot more sense now! Very interesting perspective and thank you for sharing.

Very interesting framework.

Really like the way you think about finance and credit(Invoice Financing etc). Keep it up 👍